Market Cap

Market capitalization, often referred to as market cap, is a key metric in the world of finance that provides valuable insights into the value and size of a publicly traded company. Investors and analysts use market cap to assess a company’s relative size in the market and make informed decisions about their investment portfolios. In this comprehensive guide, we will delve into the concept of market capitalization, its calculation, significance, and its implications for investors.

Table of Contents

ToggleWhat is Market Capitalization?

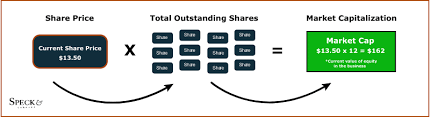

Market capitalization is a measure of the total value of a publicly traded company’s outstanding shares of stock. It is calculated by multiplying the current market price per share by the total number of outstanding shares. In essence, market cap represents the theoretical market value of a company, assuming that all outstanding shares could be sold at the current market price.

Market Capitalization Formula:

Market Cap=Current Market Price per Share×Total Outstanding SharesMarket Cap=Current Market Price per Share×Total Outstanding Shares

Understanding the Categories:

Market cap is typically categorized into three main groups:

- Large Cap:

- Market cap usually exceeding $10 billion.

- These companies are often well-established, stable, and have a long history of consistent performance.

- Examples include multinational corporations like Apple, Microsoft, and Amazon.

- Mid Cap:

- Market cap generally ranging between $2 billion and $10 billion.

- These companies are considered to be in a phase of growth and expansion, with the potential for increased market share and profitability.

- Examples include companies like Square, Slack, and Etsy.

- Small Cap:

- Market cap typically below $2 billion.

- These companies are often in the early stages of development, with higher growth potential but also higher volatility.

- Examples include smaller technology startups or local businesses.

Significance of Market Capitalization:

- Size and Stability:

- Market cap provides a quick and effective way to gauge the size and stability of a company.

- Large-cap companies are generally perceived as less risky due to their established market presence and resources.

- Risk and Reward:

- Investors often associate smaller market cap with higher risk and potentially higher returns.

- Small-cap stocks may experience greater price volatility, providing opportunities for significant gains but also posing increased risks.

- Investor Interest:

- Market cap influences investor interest and institutional investment decisions.

- Large-cap stocks are more likely to attract institutional investors, such as mutual funds and pension funds, due to their perceived stability.

- Benchmarking:

- Market cap is crucial for benchmarking a company against its peers and industry standards.

- It helps investors understand a company’s position in the market relative to others in the same sector.

- Index Inclusion:

- Many stock market indices, like the S&P 500 or the Dow Jones Industrial Average, use market cap as a criterion for inclusion.

- Companies with larger market caps have a more significant impact on these indices.

Conclusion:

Market capitalization is a fundamental metric that plays a pivotal role in the world of finance. It provides investors with valuable insights into a company’s size, stability, and growth potential. Understanding market cap categories, such as large-cap, mid-cap, and small-cap, enables investors to make informed decisions based on their risk tolerance and investment objectives. As with any financial metric, market cap is just one of many factors to consider when evaluating investment opportunities, but it serves as a crucial building block for constructing a well-diversified and balanced portfolio.